Dear friends,

Welcome to the January issue of Mutual Fund Observer.

January was named after Janus, the tutelary deity of the year’s first month. As tutelary, he was guardian, patron, and protector. Absent from the Greek pantheon, Janus was the Roman god of beginnings, transitions, and endings. It was the “transitions” part that led Romans to place the two-faced god near entries and passageways, where he oversaw their comings and goings.

Janus, ca 1225-1230, Museum of Ferrara Cathedral, Ferrara, Italy. (He’s holding a jug of wine, which might be a clue to what he sees.)

This was a strange, liminal time of year in ancient Rome. Traditionally, the old year ended with a solstice festival, and the new year began around the time of spring planting, in March. In between those two events was an imprecise, unnamed period roughly corresponding to January and February. Even after January and February were formalized, they were seen as the end of the preceding year rather than the beginning of a new one.

When exactly the year began was up to the high priest of Rome’s College of Pontiffs, the pontifex maximus. Since politics is the second-oldest profession (you know the first, and I suspect “brewer” was the third), things promptly got messy. Newly elected governments took power on the first day of the new year, which created an irresistible temptation for the pontifex to accelerate the start of the year when parties they favored were coming to power and to delay the new year when disagreeable parties were incoming.

(One could imagine the anguish felt by pontifex John Roberts, sympathetic with the incoming administration’s political predispositions and yet apparently fearful of “the specter of open disregard for federal court rulings,” which “ must be soundly rejected.”)

Julius Caesar eventually put his foot down to end that foolishness and disorder; the Julian reforms standardized both the date the year began and the rhythm of the months.

But through it all, January was a month for taking stock, looking both upstream and down as we stood in the river of time. And so we shall.

Taking stock: the passing of James Earl “Jimmy” Carter (1924 – 2024)

On December 29, 2024, Mr. Carter was reunited with Rosalyn, his wife and partner of 77 years who had passed away 13 months earlier.

The Smithsonian’s Andrea Michelson offered the best one-sentence capsule of Mr. Carter’s time with us: “Carter enjoyed the longest life of any U.S. president, and he made his many years count.” We think of him as a simple man and yet he was an Annapolis graduate involved in the design and development of nuclear propulsion plants for naval vessels. His studies in nuclear engineering were disrupted only by his father’s sudden death.

As a practical matter, his political career centered on a single decade – 1971-1981 – in which he served as Georgia’s governor and America’s president. Mr. Carter walked to his inauguration; he was only the second American president, after Thomas Jefferson, to do so, and celebrated the fact that children in the crowd called out “Hi, Jimmy!” He enrolled his daughter in a public school; he was only the second American president, after Teddy Roosevelt, to do so. His presidency saw normalizing relations with China, returning the Panama Canal to Panama, and negotiating the Camp David Peace Accords between Egypt and Israel. He was the first president to understand the risk of climate change and acted vigorously to encourage research, fossil fuel alternatives (including placing solar panels on the roof of the White House), and conservation. In all candor, he was a better person than a president; his policies were more driven by politics (likely a misreading of politics) than principle and encouraged coal as much as solar. In any case, his successor quickly reversed all of those initiatives, setting the stage for decades of diddling in the face of the greatest challenge of our age.

Mr. Carter devoted the second half of his life to public service activism. Rather than establish a self-serving “presidential library,” he created a center for conflict resolution, the Carter Center. Instead of talking, he embraced doing. Claire Jerry, curator of political history at the Smithsonian’s National Museum of American History noted, “He doesn’t just talk about housing issues; he’s building houses. He doesn’t just talk about fair elections; he’s traveling the world to ensure that they happen. He’s actually doing the things that other people only give words to.” He ultimately contributed to the construction of 4,000 homes and spent time in 140 different countries.

Mr. Carter devoted the second half of his life to public service activism. Rather than establish a self-serving “presidential library,” he created a center for conflict resolution, the Carter Center. Instead of talking, he embraced doing. Claire Jerry, curator of political history at the Smithsonian’s National Museum of American History noted, “He doesn’t just talk about housing issues; he’s building houses. He doesn’t just talk about fair elections; he’s traveling the world to ensure that they happen. He’s actually doing the things that other people only give words to.” He ultimately contributed to the construction of 4,000 homes and spent time in 140 different countries.

Our challenge now is not to mourn the passing of a remarkable man. It’s to celebrate the fact that we had time with him and had time to learn from him: to learn about charity and human decency, about ambition tempered by humility, about the power of rolling up our sleeves and doing the work that needs to be done. Jimmy Carter showed us that true leadership isn’t measured in grand pronouncements but in hammer strikes and foundation stones, in showing up where help is needed most. His greatest legacy may be the simple truth he lived every day: that one person, committed to action and guided by compassion, can build homes, heal communities, and change lives. The best way to honor his memory isn’t with words but with work – by picking up our own hammers, finding our own causes, and transforming our own corners of the world with the same quiet determination that defined his remarkable life.

Take stock: 2024’s Hidden Progress, A Year of Remarkable Gains

There is no real question that the global climate is becoming less stable and less hospitable; the rate of deterioration has been accelerating and the prospect of disastrous disruptions (through the effect of so-called feedback loops where, for example, warming thaws permafrost which releases unanticipated gigatons of methane which further accelerates warming) can’t be ignored.

And yet, progress requires hope. An optimistic mindset is associated with both good health and personal success because optimists are able to see opportunities and seize them; pessimists see threats and recoil from them. On measures such as extreme poverty, infant mortality, and human rights, despite occasional setbacks like wars and pandemics, things are getting dramatically better, not worse.

For those seeking a satisfying answer to the question, “What’s there to be optimistic about, Snowball?” here’s a partial list of 2024’s victories.

The headlines in 2024 frequently painted a picture of global turmoil and political upheaval. Yet beneath these headlines, humanity continued its quiet march of progress. The world is now ten gigatonnes below the worst-case CO2 emissions scenarios of a decade ago. While it’s easy to fret about Insta-addled youth being driven to misery by toxic comparisons and Shein fashions, the reality is that 80% of the world’s youth live in emerging economies and they are “far better off than their parents were. They are richer, healthier and more educated; those who have smartphones are better informed and connected …. Small wonder that, in a survey by the UN in 2021, the young in emerging economies were more optimistic than those in the rich world” (“Reasons to be cheerful about Generation Z,” The Economist, 4/20/24, paywall possible). Clean energy is transforming not just electricity generation but transport and industry. While daunting challenges remain, 2024’s achievements demonstrate that humanity’s capacity for positive change continues undiminished.

Solar power installation shattered all previous records. Global solar installations reached an unprecedented 660GW in 2024, a 50% increase from 2023. The pace of deployment accelerated dramatically – what once took a month in 2010 now takes just 12 hours. Solar became not only the cheapest form of new electricity in history but also the fastest-growing energy technology ever deployed.

Battery storage transformed renewable energy economics. Global battery storage capacity surged 76% in 2024, making investments in solar and wind energy significantly more attractive. Price wars between Chinese manufacturers pushed costs to record lows, while manufacturing capacity increased by 42%, setting the stage for rapid growth in both grid storage and electric vehicles.

China completed the world’s largest desert containment project. A 3,000-kilometer green belt around the Taklamakan Desert was completed after 46 years of effort. The project, which is over a kilometer wide in places, effectively “locked the desert shut,” marking the completion of the first phase of the planet’s largest ecological restoration project.

The American chestnut is coming back. The American chestnut once dominated our eastern forests. After being virtually wiped out by fungal blight a century ago (think “four billion dead trees”), genetically modified chestnuts are now being planted across New York state. A new biotech startup called American Castanea is leading commercial efforts to restore the species, with plans to plant millions of blight-resistant trees that could transform Eastern forests and provide a model for saving other threatened tree species. (You can barely imagine how cheered I am at the prospect.)

The American chestnut is coming back. The American chestnut once dominated our eastern forests. After being virtually wiped out by fungal blight a century ago (think “four billion dead trees”), genetically modified chestnuts are now being planted across New York state. A new biotech startup called American Castanea is leading commercial efforts to restore the species, with plans to plant millions of blight-resistant trees that could transform Eastern forests and provide a model for saving other threatened tree species. (You can barely imagine how cheered I am at the prospect.)

The Klamath River flowed freely for the first time in a century. The largest dam removal project in U.S. history was completed ahead of schedule and on budget. Within one month of the removal of four major dams, hundreds of salmon returned to spawn in previously blocked areas, opening up 400 miles of habitat.

Amazon deforestation was cut in half over two years. Brazil’s deforestation rates dropped dramatically under President Lula’s administration, approaching all-time lows. Colombia’s deforestation fell by 36%, hitting a 23-year low, while 62.4% of the Amazon rainforest came under some form of conservation management.

The whale population recovery exceeded all expectations. Thanks to the 1985 commercial whaling moratorium, multiple whale species showed remarkable recovery. Humpback populations in Icelandic waters and the South Atlantic Ocean returned to pre-whaling levels, while blue whales were spotted in the Seychelles for the first time in decades.

Native otters solved an invasive species crisis. European green crabs are one of the most widespread invasive marine species on the planet. They are predatory, prolific, and destructive to native shellfish and the marine environment and have no natural predators in the western … Oh, wait! About that. Turns out that sea otters react to green crabs about the way Midwesterners reacted to Red Lobster’s ill-fated “all you can eat” shrimp offer by scarfing down a thousand of the crabs a year. Southern sea otters along the U.S. West Coast reduced invasive European green crab populations by 90-95%. Just 120 otters consumed between 50,000 and 120,000 crabs annually at the Elkhorn Slough National Estuarine Research Reserve, demonstrating nature’s capacity for self-regulation.

Native otters solved an invasive species crisis. European green crabs are one of the most widespread invasive marine species on the planet. They are predatory, prolific, and destructive to native shellfish and the marine environment and have no natural predators in the western … Oh, wait! About that. Turns out that sea otters react to green crabs about the way Midwesterners reacted to Red Lobster’s ill-fated “all you can eat” shrimp offer by scarfing down a thousand of the crabs a year. Southern sea otters along the U.S. West Coast reduced invasive European green crab populations by 90-95%. Just 120 otters consumed between 50,000 and 120,000 crabs annually at the Elkhorn Slough National Estuarine Research Reserve, demonstrating nature’s capacity for self-regulation.

Murder hornets have been completely eradicated from the United States. And British Columbia. After first appearing in Washington state four years ago and sparking widespread concern, the invasive species was eliminated through coordinated efforts. The successful eradication involved over 1,000 citizen scientists and dedicated beekeepers working alongside officials.

Global access to education reached historic levels. Between 2000 and 2023, the number of children not attending school fell by nearly 40%. Eastern and Southern Africa achieved gender parity in primary education, with 25 million more girls enrolled than in the early 2000s. Since 2015, an additional 110 million children entered school worldwide.

College has become significantly more affordable in the United States. Average in-state tuition at public universities dropped to $11,610, down from $12,830 five years ago. Major institutions like Cooper Union reinstated free tuition traditions, while MIT extended free tuition to families earning below $200,000. Bloomberg’s donation ensured free medical education at Johns Hopkins University. Bad for Augie’s budget, good for yours!

School meal programs expanded dramatically worldwide. Nearly 480 million students now receive meals at school, up from 319 million before the pandemic. Nigeria plans to feed 20 million children by 2025, Kenya aims to expand from two million to ten million recipients, and Indonesia is committed to providing lunches to all 78 million of its students.

Paris transformed its urban core for people over cars. The city banned thru traffic in central areas, pledged to convert 60,000 parking spaces to trees, and saw a 40% decline in air pollution over a decade. Cyclists now outnumber motorists for trips from the suburbs to the city center, marking a fundamental shift in urban mobility.

African cities pioneered urban environmental solutions. Kigali, Rwanda, became Africa’s cleanest city through innovative community-based policies and initiatives. The success provides a model for rapidly growing cities in developing nations to achieve environmental sustainability.

Cities globally expanded green infrastructure. Berlin became a “sponge city” designed to capture and reuse rainwater, while New York opened 60km of new greenways. These achievements demonstrate how cities are developing nature-based solutions to climate challenges.

A game-changing HIV drug emerged as a potential pandemic-ender. Lenacapavir showed 100% efficacy in preventing HIV infections during African trials, marking the closest thing to a vaccine in four decades. By year’s end, manufacturer Gilead had committed to providing affordable versions to 120 resource-limited countries and was developing a single annual shot version.

Tuberculosis deaths hit their lowest level ever recorded. Africa led global progress with a 42% reduction in deaths and a 24% decrease in infection rates since 2015. Ethiopia achieved a sixfold drop in infections since the 1980s, while Cambodia saved an estimated 400,000 lives this century. New oral treatments now allow patients to be cured in half the conventional time.

The opioid crisis showed its first sustained reversal. U.S. overdose deaths dropped by an unprecedented 15% in 2024, representing 20,000 fewer deaths than the previous year. Both researchers and frontline workers confirmed this marked a genuine turning point in the epidemic.

Global disease elimination reached historic milestones. Multiple countries eliminated long-standing diseases in 2024, including leprosy in Jordan, sleeping sickness in Chad, and maternal tetanus in Guinea. India, Vietnam, and Pakistan eliminated trachoma, while Brazil and Timor-Leste eliminated elephantiasis. These successes demonstrate the effectiveness of coordinated public health campaigns.

Brain-machine interfaces restored human speech. An ALS patient regained the ability to speak to his daughter through revolutionary sound decoders and AI software. The breakthrough is part of a new wave of brain-machine interfaces that could transform life for paralyzed individuals.

Artificial intelligence revolutionized disease detection. AI systems demonstrated unprecedented accuracy in medical diagnosis, from spotting skin cancer to finding hidden brain tumors in seconds. ChatGPT-4 outperformed human doctors in diagnostic tests, while AI tools in 1,400 GP clinics boosted cancer detection rates across England.

Critical mineral concerns evaporated. Known reserves of essential minerals increased dramatically: enough lithium for 250 million EVs, cobalt for 500 million EVs, and copper for 1.7 billion EVs was discovered. Major deposits were found in Arkansas, Wyoming, and Norway, alleviating concerns about resource scarcity.

And while you might think of it as silly, I’m cheered by the stories of the Chinese zoo that tried to disguise dogs as pandas because … well, they couldn’t get pandas, and Chinese zoos really need to have pandas and so …voila! Paris is opening a cheese museum, the Musee du Fromage this summer. (Wisconsin is jealous.) Dolly Parton launched a line of Dolly Wines (in a typically Dolly fashion she was engaged with every part of the process, from selecting the wines to designing the bottles), which offset the sting of learning that Fruit Stripe gum is no more. (Where now will I get my collectible zebra tattoos?) And, scientists have demonstrated what mystics knew: a feeling of awe – think about standing at the base of the Grand Canyon and looking up – slows our sense of time, a phenomenon known as time dilation.

And while you might think of it as silly, I’m cheered by the stories of the Chinese zoo that tried to disguise dogs as pandas because … well, they couldn’t get pandas, and Chinese zoos really need to have pandas and so …voila! Paris is opening a cheese museum, the Musee du Fromage this summer. (Wisconsin is jealous.) Dolly Parton launched a line of Dolly Wines (in a typically Dolly fashion she was engaged with every part of the process, from selecting the wines to designing the bottles), which offset the sting of learning that Fruit Stripe gum is no more. (Where now will I get my collectible zebra tattoos?) And, scientists have demonstrated what mystics knew: a feeling of awe – think about standing at the base of the Grand Canyon and looking up – slows our sense of time, a phenomenon known as time dilation.

The Japanese practice of forest bathing, known as “shinrin-yoku,” embodies that insight. The practice involves being calm and quiet in nature, observing the surroundings, and breathing deeply. Participants are encouraged to turn off devices, move slowly, and engage their senses fully. Studies have shown that forest bathing can lower blood pressure, alleviate depression and anxiety, improve sleep quality, and boost the immune system. It is now recognized as a vital part of preventative healthcare in Japan. And you can practice it in your backyard once you get past an obsession with “perfect lawns” and “flowers of the year.”

Three questions for you:

- Did you know any of this?

- If not, why not?

- What might you do about it?

In answer to questions 1 and 2, most people don’t know how good we’ve got it because doom (doom-scrolling on your part and doom-casting on the media’s part) is vastly more profitable than the truth. The truth, so far as I can tell, is that the world is vastly less screwed-up and lives are vastly better than at any point in history.

The answer to question 3 is the easiest and hardest of all: step away from the mediated world and step into the immediate (aka “real”) one. Put your phones away. Hug someone today. Smile at a stranger. Do a good deed. Be like Jimmy.

– – – – –

Progress is rarely dramatic. It’s built day by day through the determined efforts of scientists, healthcare workers, conservationists, educators, and ordinary citizens working to solve problems both great and small. While 2024’s headlines often focused on conflict and crisis, millions of people worldwide continued humanity’s long tradition of quietly building a better world. From eliminating diseases that have plagued us for millennia to restoring ecosystems we once thought lost forever, from expanding educational access to developing breakthrough medical treatments, their achievements remind us that human ingenuity and cooperation remain our most powerful tools for positive change.

As we face the challenges ahead – from climate change to political polarization to emerging technologies – 2024’s hidden successes offer an important lesson: progress is possible when we combine scientific innovation with human compassion, when we balance technological advancement with environmental stewardship, and when we measure success not just in profits but in human flourishing. While the path forward isn’t always clear, our capacity to solve seemingly intractable problems remains undiminished.

Without any question, we face a multitude of challenges. We need to return to operating with a modicum of trust in one another and of faith in our institutions. We need to accept evidence rather than conspiracy. We need to adult up if we want to bequeath a better world to our children and to theirs.

But we can.

And we will.

In the January Mutual Fund Observer …

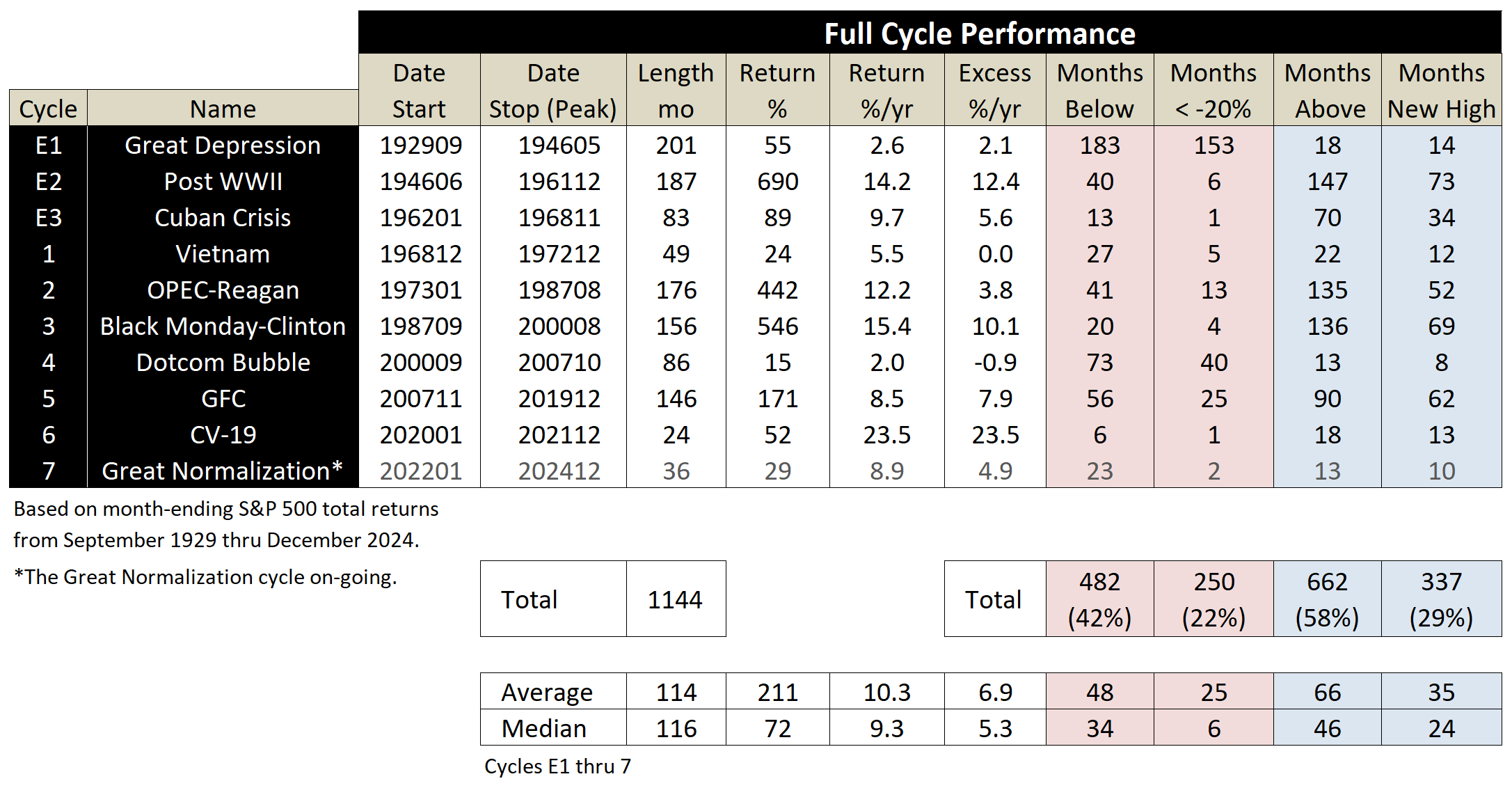

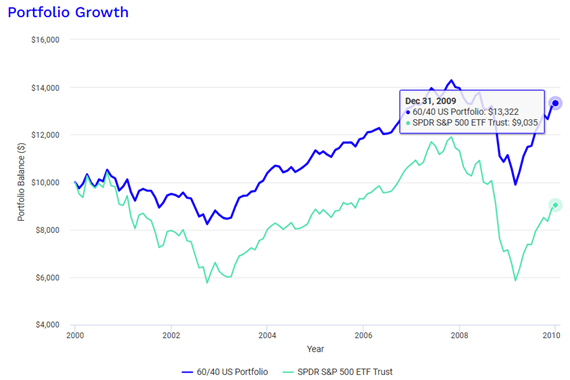

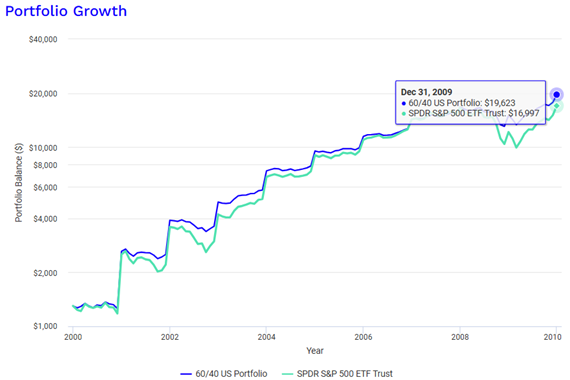

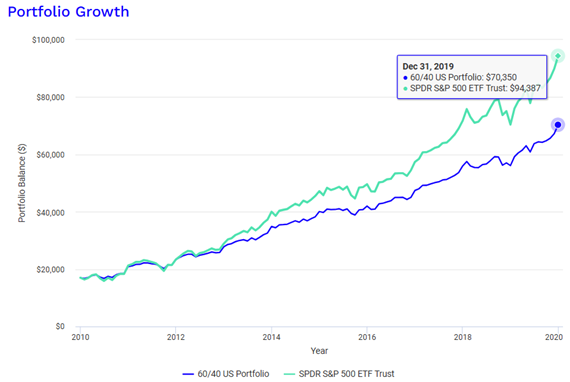

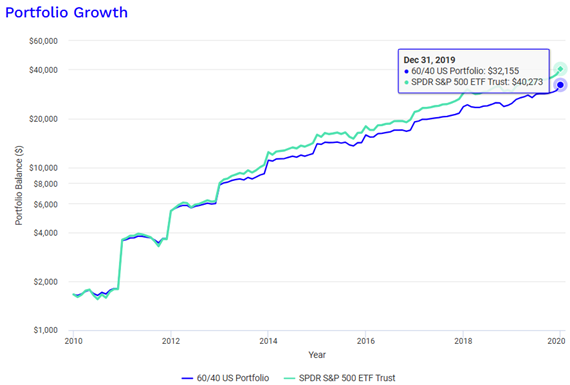

Much of our success as investors is driven by two factors: a good plan and resilience in executing it. Our colleague Lynn Bolin recommends “Lifetime Investment Strategies For Younger Investors” that focus on time and patience much more than on hot topics. He demonstrates that even during challenging bear markets like 2000-2010, young investors who consistently invest small amounts (as little as $5 per day) can build significant wealth over time. Behaviors that support a “rich” life:

- The importance of automated savings

- Increasing financial literacy

- Building a “margin of safety” for unexpected events

- Maintaining work-life balance while not sacrificing long-term savings

- Having both emergency savings and retirement savings

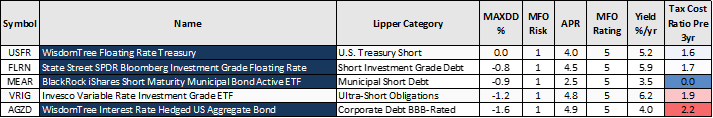

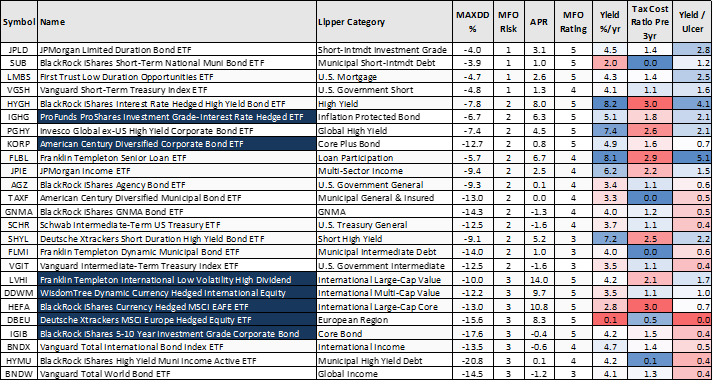

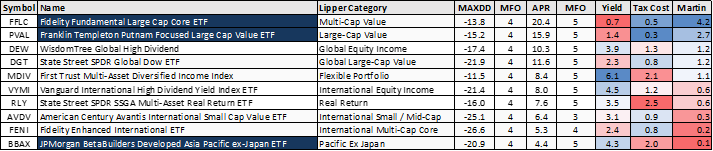

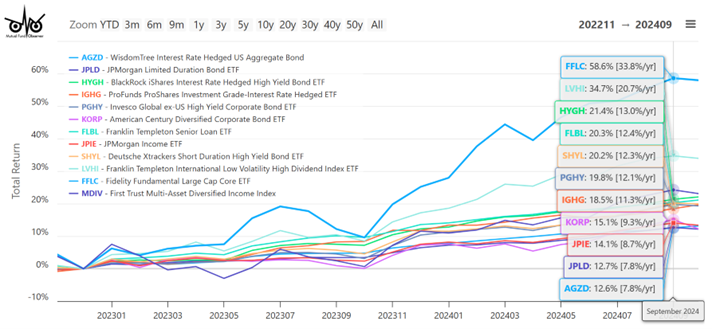

For those looking for concrete recs rather than long-term reflections, Lynn also offers “My ETF Picks for the Bucket Approach In 2025.” Lynn is optimistic about intermediate-term bond opportunities while being cautious about equity valuations.

As is our tradition, we try to start the year with a note of realistic optimism. Jeff Bezos strikes me as a detestable wanker, but we do agree that almost everything, including infant mortality, global literacy, and global poverty rates, has improved over the last 50 years. Everything except the climate:

When people talk about the good old days, that’s such an illusion. Almost everything is better today than it was … with one exception, which is the natural world.

(One of the Washington Post’s cartoonists tried to capture Bezos genuflecting with others of his class before a statue of Mr. Trump. It was quickly spiked and the cartoonist resigned.)

Draft cartoon, courtesy of Ann Telnaes via The Wrap

It’s easy to become despondent over the torrent of despair pouring from the media, mainstream and otherwise. Such despondence blinds us to opportunities and makes our lives some combination of “nasty, brutish and short.” And so, we want to offer a celebration of the miracles that routinely transpire when smart and good people put their minds to changing the world for the better. (Murder hornets, take notice.)

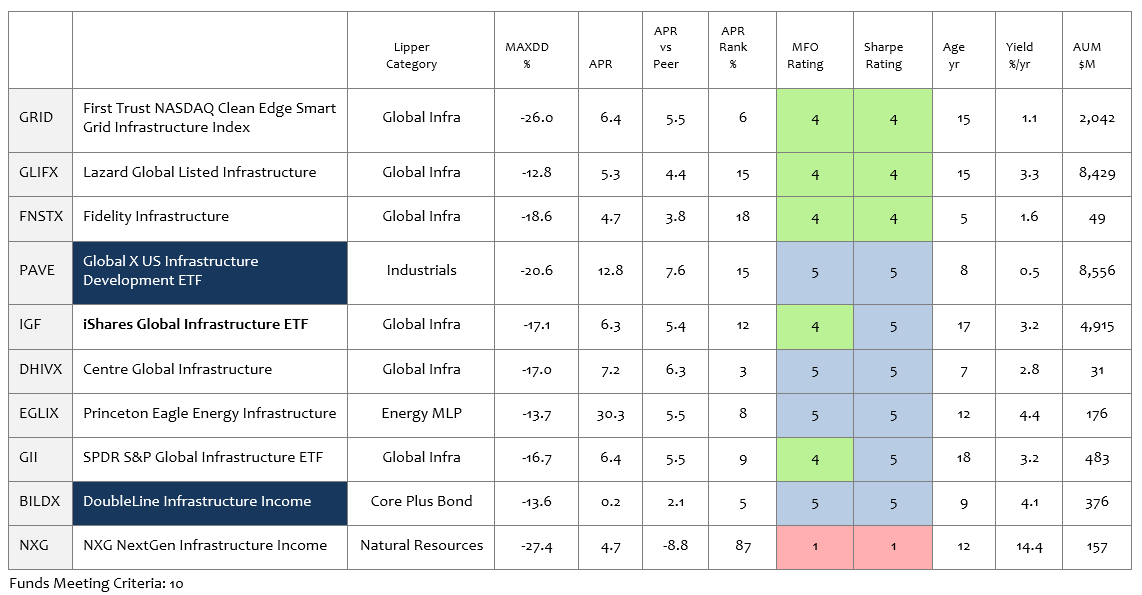

In “Not Built for This,” I try to balance long-term reflections on the worsening state of the global climate with specific (some might say “concrete”) recommendations for infrastructure funds that might prosper as a result of our belated attempts to manage the consequences of our failure to make serious attempts to moderate climate change. This essay builds on four simple arguments:

- Infrastructure is the umbrella term for all of those creations that make modern society possible.

- Our infrastructure, much dating to the early 20th century, was never designed for the world we’ve created.

- Politicians can ignore global climate change.

- Politicians cannot ignore infrastructure collapses. While climate change is distant, abstract and somebody else’s problem, the collapse of a city’s water treatment is an existential threat to state and local politicians. They will respond.

We highlight a half dozen funds that might be variously poised to profit from those responses.

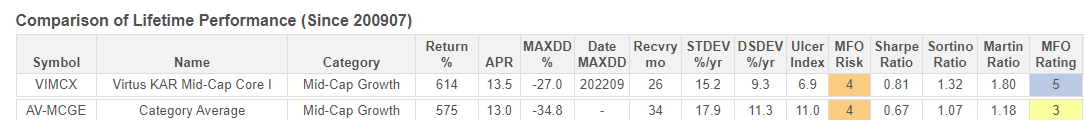

And, in a bargain-obsessed world, we offer a Launch Alert for Virtus KAR Mid-Cap ETF. It’s an active ETF whose strategy parallels five-star institutional funds – but is offered at a one-third discount.

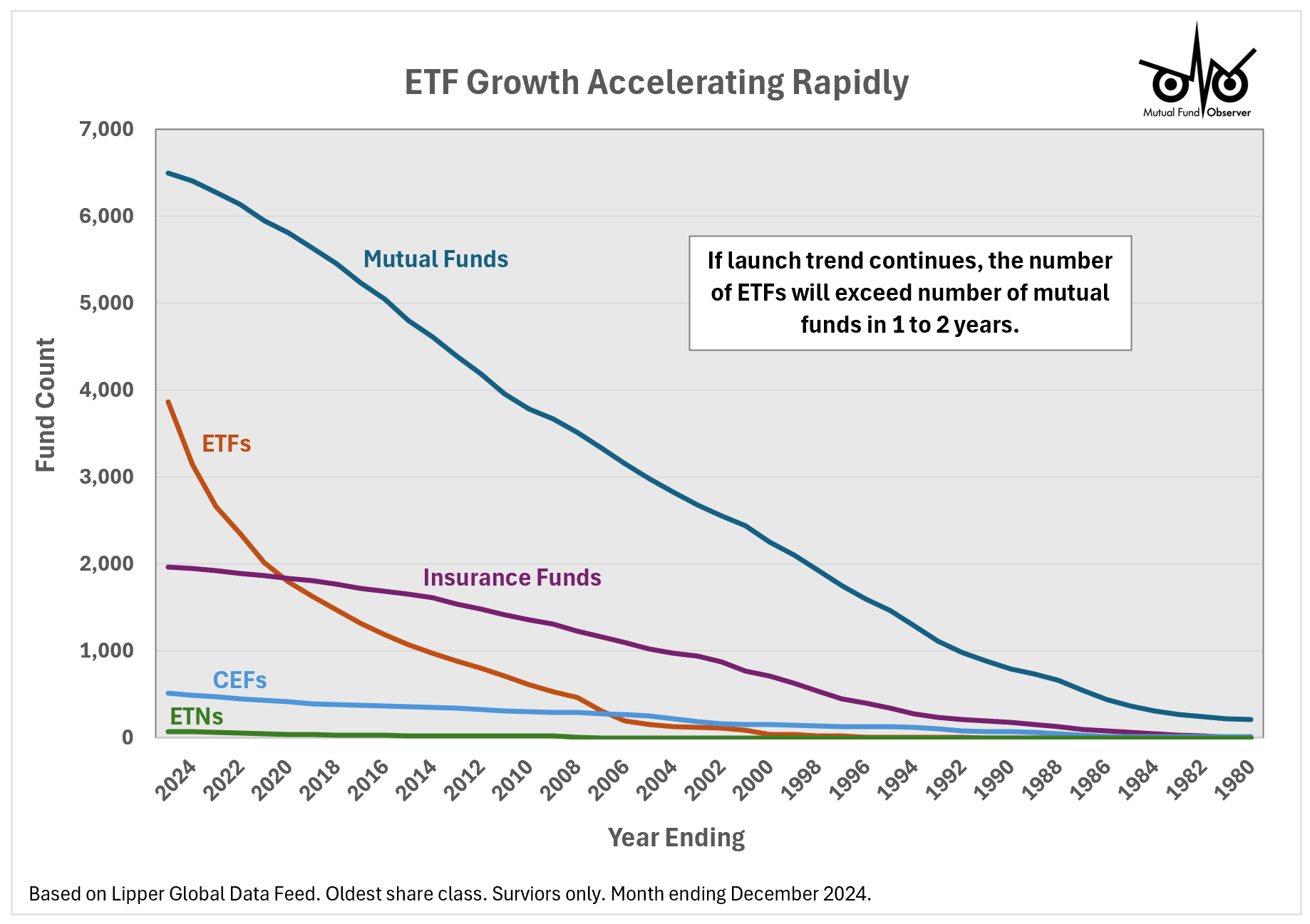

Speaking of launching an ETF, this month, Charles shares, “You Too Can Start an ETF,” which attempts to highlight the burgeoning ETF marketplace and the challenges we, investors, and advisors face in understanding just who is behind the various strategies being offered.

The Shadow, as ever, shares the month’s most striking changes in the fund and ETF world in “Briefly Noted.”

Thanks, in this New Year to …

The good folks at CrossingBridge and Cook & Bynum for enriching our winter reading stack (Amy Tan’s Backyard Bird Chronicles is drawing to a close), and to Brad Barrie and the folks at the Dynamic Alpha Funds for the cookies that go with it!

Thanks to Matt, for words of good cheer in response to a somber question in our December issue:

Regarding “is this still worth doing? Are we making a difference?” – my answer to both is an emphatic “Yes!” I always look forward to each issue and never miss reading it. I especially appreciate Briefly Noted, since it’s so easy to miss fund-specific developments (I’m really looking forward to the launch of Tweedy, Browne’s COPY, for example). I view the launch of so many active ETFs as a positive, so it’s valuable to get a heads-up on some of the more interesting ones on the horizon. And your sense of humor is always on point – I only just noticed this gem and might need to borrow some of it: “…and spends an amazing amount of time ferrying his son, Will, to baseball tryouts, baseball lessons, baseball practices, baseball games … and social gatherings with young ladies who seem unnervingly interested in him.”

Thank you, Matt. You make a difference.

Thanks to Doug, one of our stalwart subscribers, whose monthly contribution arrived at dawn on Christmas morning, and to Greg, another regular, whose support arrived on New Year’s Day morning. Both were sources of unreasonably good cheer. It’s good to know you’re there.

Thanks to Doug, one of our stalwart subscribers, whose monthly contribution arrived at dawn on Christmas morning, and to Greg, another regular, whose support arrived on New Year’s Day morning. Both were sources of unreasonably good cheer. It’s good to know you’re there.

Thanks to the Grinch, on his way down Mt. Crumpet, who shared a gift on Christmas Day.

Thanks, as always, to our other regular contributors S&F Investment Advisors, Wilson, William, William, Stephen, Brian, and David.

And, to John from Wexford, Kathy of MA, Benjamin from Ann Arbor, Philip of MI, and Charles from Indy, thank you.

As ever,